Imagine your policyholder just had a minor car accident. Instead of searching for a claims number, waiting on hold, and getting further frustrated, they simply open their insurance app and type, “I just had a fender bender in a parking lot, what do I do next?” Instantly, your intelligence assistant guides them through the process, helping upload photos and even reassuring them that everything is being handled, all within mininutes, any time of day or night.

This isn’t a distant vision. Leading insurers are already proving what’s possible when AI meets the claims journey. For example, Aviva, the UK’s largest general insurance company, rewired its entire claims process using AI. By embedding more than 80 advanced AI models across operations, Aviva cut the average time to assess liability in complex cases by 23 days, improved routing accuracy by 30%, and reduced customer complaints by 65%. Most impressively, customer satisfaction scores climbed more than sevenfold.

This powerful AI solution transforms every touchpoint. It can handle routine inquiries, use natural language to gather information from claims, and ensure complex issues are quickly passed to the human expert. Incorporating conversational AI for insurance creates a seamless partnership between AI and agent, building deeper customer engagement and lasting loyalty.

There’s so much more to conversational AI for insurance than simple chatbot FAQs and 24/7 help, and this article will explore most of those opportunities. They’ll demonstrate how implementing conversational AI insurance solutions is a strategic investment in efficiency and growth.

What Is Conversational AI in Insurance?

Conversational AI is an advanced technology that uses artificial intelligence and machine learning to understand context, intent, and even nuance. Traditional chatbots usually follow rigid scripts, which prevents them from engaging in more sophisticated and human-like customer service interactions (unlike conversational AI).

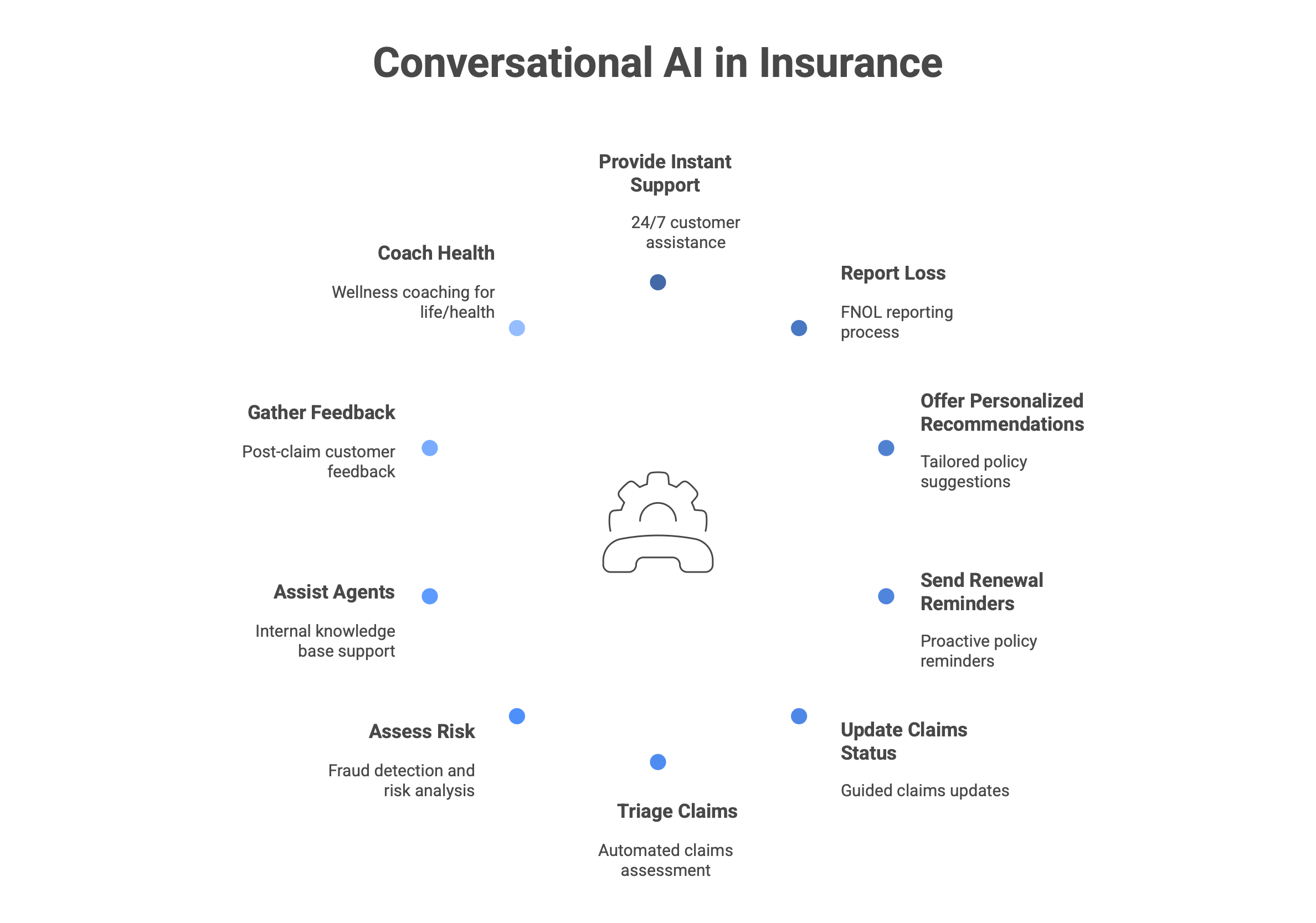

In the insurance industry, these tools handle a wide range of tasks (answering customer inquiries, guiding users through complex insurance processes like the claims process, and more). Additionally, they can provide personalized responses thanks to their ability to analyze vast customer data. With conversational AI in your insurance company, you can automate repetitive tasks, significantly improve response times, and increase overall customer satisfaction:

24/7 instant customer support & FAQs

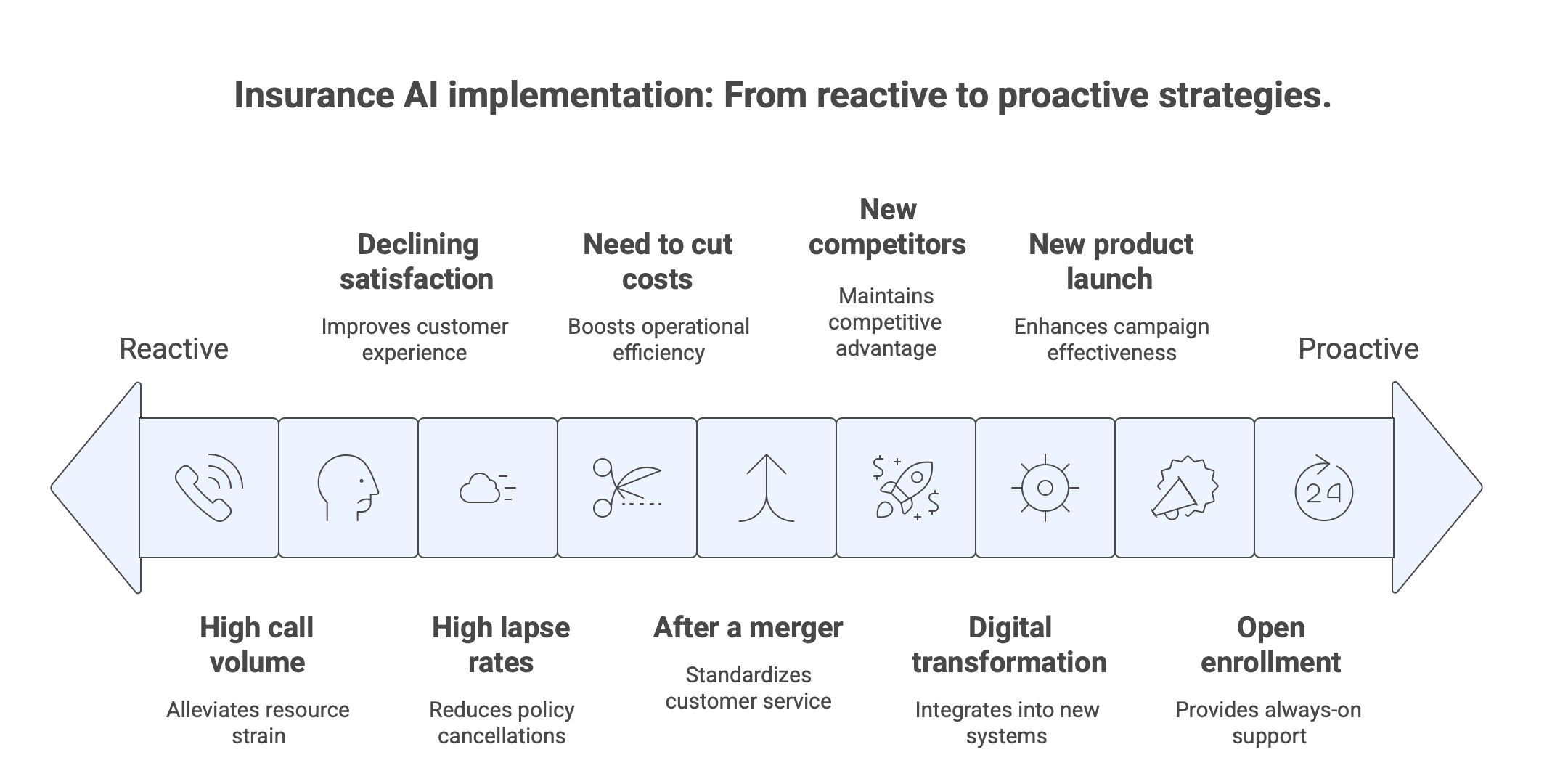

Customers today expect immediate answers to their questions (day or night). This use case showcases how conversational AI in insurance can act as an always-available digital front door. It can automate responses to FAQs, and companies can meet customer expectations for instant service without spending extra resources.

- The use case. The tool can handle a high volume of common, repetitive inquiries instantly and accurately, without human intervention. It ensures that basic customer needs are met immediately, regardless of the time or day.

- Benefits. The primary benefits of implementing a 24/7 conversational AI customer support system are significantly improved operational efficiency and enhanced customer experience.

- Who benefits the most? This tool is especially significant for large and direct-to-consumer insurance providers with a high volume of customer interactions. Smaller companies, looking to scale their customer service capabilities, also benefit from 24/7 automated services.

- When to implement? The ideal time to implement conversational AI into insurance operations is during a digital transformation initiative or when call center volume for simple customer queries becomes unsustainable and costly.

First notice of loss (FNOL) reporting

The FNOL process is a critical touchpoint in the insurance sector. It sets the tone for the entire claims experience. With conversational AI insurance apps, you can transform this traditionally tiring and stretched-out step into a guided, empathetic, and efficient digital interaction.

- The use case. This application involves using a virtual assistant to automate something usually done manually. They guide the customer through the initial step of officially reporting a claim, capturing all essential details, documents, and evidence, available 24/7.

- Benefits. The core benefit of AI-driven FNOL is a dramatically streamlined and less stressful claims process for the customer. The ease of use and immediate acknowledgment provided by the virtual assistant can also significantly reduce customer anxiety after a disruptive event.

- Who benefits the most? These virtual agents are essential for any property and casualty insurer. It is particularly efficient for companies with a diverse customer base that requires multilingual support.

- When to implement? If you identify FNOL as a significant bottleneck leading to customer dissatisfaction, implementation is ideal. It can also be a strategic priority for companies undergoing modernization of their core policy management and claims systems.

Personalized policy recommendations & quotes

Customers often find it difficult and tiresome to find the right insurance coverage. By using AI to transform this process into a guided experience that feels less like a transaction and more like a consultation, you’re giving your customers a unique experience and comfort.

- The use case. This app involves using an AI chatbot as a digital insurance advisor. Your AI bot will engage with the customers, ask them questions, and analyze their answers to understand their unique risk profile and specific needs. It can generate personalized policy recommendations and accurate quotes in real time.

- Benefits. The primary benefit of using AI this way is a superior sales conversion rate driven by a frictionless and personalized buying experience. It also delivers significant cost savings by automating the initial qualification and quoting stages, allowing the sales team and human insurance agents to focus on closing the deals.

- Who benefits the most? This tool is exceptionally powerful for direct-to-consumer insurers, insurtech startups, and any provider looking to accelerate digital sales.

- When to implement? The ideal time is when a company seeks to grow its digital market share, reduce customer acquisition costs, or simplify a product lineup that customers find confusing.

Proactive policy renewal & payment reminders

The insurance sector has a competitive market. Clients often have to choose from various insurance services and providers, making finding new clients increasingly complex for companies. In general, retaining an existing customer is far more cost-effective than acquiring a new one, so providers need to streamline claims, deliver faster responses, and improve overall customer experience to build loyalty.

- The use case. This tool uses conversational AI insurance apps to automate personalized outreach to policyholders ahead of critical deadlines. Such insurance chatbots can send timely reminders for upcoming renewals and payment due dates.

- Benefits. The core benefits are a direct increase in customer retention rates and reduced lapsed policies. Such an approach reduces the need to manually chase renewals and late payments, improving admin cost savings.

- Who benefits the most? The application is universally beneficial across the insurance industry. It is particularly critical for companies with a large volume of short-term policies.

- When to implement? This should be a high-priority implementation for any insurer looking to reduce involuntary churn and improve retention metrics. It is also a logical next step after deploying a 24/7 support chatbot.

Guided claims status updates

Surveys show that customers hate the claims process, describing it as a “black box.” It often leads to anxiety, frustration, and a high volume of status inquiry calls that strain the call center resources. Conversational AI insurance tools help create more transparency, empower customers to get instant answers, and deliver services anytime, from anywhere.

- The use case. Think of this tool as a self-service channel where policyholders can receive automated updates on the progress of their insurance claim through a user-friendly interface.

- Benefits. The primary benefit is dramatically improving the overall customer experience by eliminating uncertainty and reducing anxiety during a stressful time. For the insurer, it generates massive cost savings by deflecting a high volume of routine status inquiry calls away from the call center.

- Who benefits the most? This tool is exceptionally valuable for any insurer processing a medium to high volume of claims, particularly in auto, property, and health insurance.

- When to implement? Implement this after or alongside an AI-powered FNOL (First Notice of Loss) system.

Automated claims triage & documentation

Sorting, prioritizing, and gathering information by hand makes the first step of the claims process a bottleneck. Conversational AI insurance apps are used to intelligently automate the intake and classification process, guaranteeing that claims are routed correctly from the start and that the required documentation is gathered in a timely and accurate manner.

- The use case. This tool automatically evaluates the type, complexity, and seriousness of a recently filed claim using an artificial intelligence chatbot or virtual assistant. After that, it classifies (triages) the claim and, via a facilitated discussion, gathers all necessary records and proof.

- Benefits. The main advantage is a greatly streamlined claims procedure that runs faster and more effectively. Insurers can increase customer satisfaction by automating triage, which guarantees that knowledgeable insurers handle complex issues immediately and that simple claims are processed faster. Lessening the administrative load on employees and minimizing data collection errors leads to significant cost savings. Thanks to the guided documentation collection, a more thorough and accurate claim file is produced at the beginning, which also cuts down on back-and-forth and delays.

- Who benefits the most? For big P&C insurers and health insurance providers that deal with a lot of claims of various complexity, this is especially revolutionary. For businesses looking to adopt a straight-through processing model for straightforward claims, it is extremely helpful.

- When to implement? Put this into practice when there are glaring inefficiencies in the first stages of handling claims, like irregular routing, assignment delays, or missing documentation that causes delays later on.

Risk assessment & fraud detection

The widespread problem of insurance fraud costs the sector billions of dollars every year, which eventually drives up premiums for law-abiding consumers. Traditionally, it takes a lot of manual review and experience to spot suspicious claims. In order to detect possible fraud and more precisely evaluate risk in the early phases of a claim or application, this use case leverages a conversational AI platform for insurance to serve as a watchful, data-driven first line of defense.

- The use case. This application uses cutting-edge AI to analyze language, customer behavior cues, and data inconsistencies during customer interactions.

- Benefits. The company’s bottom line is directly protected by the early detection and prevention of fraudulent claims, which primarily results in significant cost savings. By taking a proactive stance, risk assessment accuracy during underwriting and claims is improved, which results in more suitable pricing.

- Who benefits the most? This tool is essential for all insurers, but it is especially important for those in industries like workers’ compensation, health, and auto insurance that are more vulnerable to fraud.

- When to implement? When an insurer observes a rise in fraudulent activity or wants to improve its analytical skills in underwriting and claims, implementation is ideal.

Internal knowledge base & agent assist

Navigating intricate policy details, changing regulations, and unique customer scenarios is a daily challenge for insurance agents. This use case focuses the power of conversational AI insurance tools inward to create a dynamic, intelligent support tool for human staff.

- The use case. This application entails implementing a conversational AI interface as an internal tool that allows human insurance agents to query in natural language to obtain guidelines, comprehend procedures, and find exact answers to complicated questions without ever leaving their workflow.

- Benefits. The main advantage is a sharp rise in agent accuracy and efficiency, which improves the overall customer experience. By offering immediate responses, it significantly lowers the average handle time per call, which results in significant cost savings and the capacity to handle larger call volumes.

- Who benefits the most? Large insurers with extensive product portfolios and intricate, regularly updated policies will find this tool invaluable.

- When to implement? Implement this when agent efficiency metrics (like average handle time) are a concern, or when ensuring 100% compliance and accuracy in customer responses is a top priority.

Post-claim support & customer feedback

An important factor in determining a customer’s long-term perception of their insurer is the resolution of a claim. This stage is typically disregarded, which is a lost chance for involvement and development.

- The use case. After a claim has been closed, this application uses an AI chatbot or virtual assistant to automatically get in touch with a customer.

- Benefits. The main advantage is that claim closure has evolved from a straightforward administrative duty to a calculated instrument for increasing client loyalty and satisfaction.

- Who benefits the most? Any insurer looking to establish a reputation for providing exceptional customer service and ongoing development will find this tool to be of great use.

- When to implement? Once core claims automation (such as FNOL and status updates) is established, put this into practice.

Health & wellness coaching (life/health insurance)

Health insurers are becoming more involved in their members’ well-being and less of a passive payer of claims. This innovative use case uses conversational AI to provide proactive, individualized health advice to members, assisting them in leading healthier lives.

- The use case. A virtual assistant serves as a member’s individualized health and wellness coach through this application.

- Benefits. By offering outstanding value beyond standard insurance coverage, this tool radically improves the overall customer experience and increases member engagement and loyalty.

- Who benefits the most? For health, wellness, and life insurance companies, especially those that cater to specific markets or offer employer-sponsored plans, this is a tactical tool.

- When to implement? Use this as a value-added service to set your insurance product apart from the competition, increase member retention, and lower the cost of long-term claims.

Get Your Own Conversational AI Tool in 5 Minutes

Are you among the insurance providers looking for a smarter way to handle customer questions, speed up claims, and make your team’s life easier? Then you could benefit from conversational AI insurance tools. The power to create more personalized, proactive, and profitable customer relationships is at your fingertips. You don’t need to be an AI expert to set your first AI agent up – CogniAgent is designed to learn your unique workflows, answer questions naturally, and handle everything from customer support to internal processes smoothly. It only takes 5 minutes, and no coding is needed.

Need a digital teammate that’s always on, always helpful, and ready to make life easier for you, your customers, and your teammates? Try our platform for free or contact us to get a demo.